Using capital to influence social and environmental change isn’t new. Investors have been focused on companies’ track records on social issues for decades now. But investing isn’t the only way of driving change—financial institutions have also tried to signal good stewardship to the markets by divesting from organizations and sectors, like oil and gas, with less than stellar reputations over sustainability objections (including recent moves by CalPERS, BlackRock, and others).

While impact investing seeks to impact social change through capital allocation to “good” companies, divestment does just the opposite – withdrawing capital from “bad” companies. But what if we moved away from this “good” vs. “bad” dichotomy and rethought our approach to impact investing? What if instead of voting with their feet, investors voted with their votes and used their influence to incentivize change in companies that they had ownership in?

Larry Fink, Chief Executive of BlackRock, set an important precedent last year. As the head of the world’s largest asset manager, Fink has encouraged a shift in focus to remain in line with ambitious commitments to achieve net-zero greenhouse gas emissions. Fink explains, “divesting from entire sectors – or simply passing carbon-intensive assets from public markets to private markets – will not get the world to net zero.”1 BlackRock has decided to incentivize and support positive change rather than divest from specific sectors. He hails the companies in carbon intensive sectors – like oil and gas – that are working to transform their businesses and predicts that they will rise phoenix-like above their peers Fink affirms, “Driving capital towards these phoenixes would be essential to achieving a net-zero world.”

Investing—not divesting—might be the best option to impact corporate behavior and create change.

Why Divestment Doesn’t Work

Divestment functions on a “vote with your dollars” logic. The thinking goes that denying capital to oil and gas companies makes it harder for companies to operate, eventually diminishing the sector’s power. But there’s one problem with this—divesting of assets requires a buyer. Divestment doesn’t mean that practices change; it just means that shareholders change.

So, if the divestment strategy rarely, if ever, works, is there an alternative method to impact the behavior of companies?

The Pressure is Only Increasing

Insurance providers and bulge-bracket banks can incentivize cleaner companies to provide accurate and measured emissions profiles. Chubb Ltd., the world’s largest publicly- traded property and casualty insurer, has gone as far as to update underwriting criteria for natural gas and extraction projects to mandate that clients measure and prove reductions in methane emissions.

“The methane-related underwriting criteria that Chubb has adopted – the first of their kind in our industry – are focused on the balance between the need to transition to a low-carbon economy and society’s need for energy security,” CEO Evan G. Greenberg said. “As a company, we are accelerating and expanding our climate-related initiatives without committing to sweeping net-zero pledges for which, in our judgment, there is not a viable path to achieve.”

Chubb also stated it would “continue to provide insurance coverage for clients that implement evidence-based plans to manage methane emissions including, at a minimum, having programs in place for leak detection and repair and the elimination of nonemergency venting. Clients must adopt “one or more measures” that reduce emissions flaring.

Chubb’s approach presents an alternative to environmentalists’ calls to eliminate coverage. By encouraging corporate responsibility and supporting emission reduction, Chubb is empowering oil and gas producers to actively address climate concerns with evidence-based plans.

Invest and Incentivize for Change

Not all investor ideas and pressure campaigns are necessarily positive. Still, evidence suggests that investors can positively influence the strategies and behaviors of companies they own or lend to. In turn, those companies have exhibited openness to creating value in different ways, including re-examining their strategies and practices.

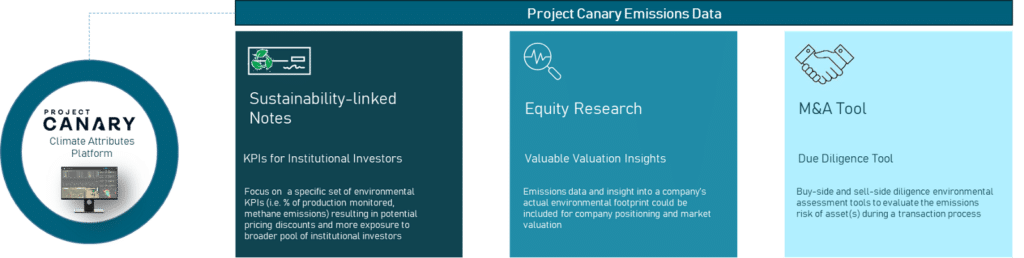

Investment in high-fidelity and granular data at the facility level is the only practical way to accurately understand a company’s emissions profile. Without this understanding, companies can’t effectively offset their emissions, leading to wasteful spending and greenwashing liability from investors and the public.

Divestment is not the answer. The investor community can drive actionable change by incentivizing oil & gas companies to monitor their assets with incremental benefits related to the percentage of production monitored. It’s time for the investor community to harness the power of granular, site-level data for capital market activities.